Want to be more intentional with your spending so you know your money is working for your goals? Or do you struggle with overspending and constantly forget to update your budget? Qube Money may be the perfect solution for you!

Early in 2021 my husband and I made the first change to our budgeting system in 11 years to join Qube Money, a budgeting and digital banking solution. And we’ve both fallen in love with the system.

So, it’s time for me to share my full review of Qube so you can be more intentional with your money too!

What is the Qube Money App?

Qube Money is a revolutionary app and banking solution that combines the power of digital banking with the intentionality of cash envelope budgeting (without all the tracking or pesky cash.)

Qube Money is a revolutionary app and banking solution that combines the power of digital banking with the intentionality of cash envelope budgeting (without all the tracking or pesky cash.)

By creating “Qubes” (envelopes) in your Qube Money account that you need to open prior to making a purchase with your card, you develop intentionality with your money and maintain a real-time picture of your spending plan.

While other budgeting tools, YNAB and EveryDollar, offer digital cash envelope style budgeting, those apps aren’t tied to your actual spending. Which means to stay accurate, those tools need to be updated for every transaction.

With Qube, you have a digital bank account that is tied to your spending categories, making your budget and your spending integrated seamlessly.

4 Reasons We Love Qube Money

As we’ve used Qube Money, we’ve found many reasons to love the app. Not least of which is that it’s saving us money! But for this review, I’ve rounded up my top four reasons for choosing to use Qube for our family.

1 - Qube Money is Proactive, not Reactive

Anytime you’re using a budgeting app or tool – even just pen and paper – you are reconciling what you’ve spent and how much money you have after the fact.

This is why sometimes you sit down to do your budget on Friday and you realize, “Oh my goodness, I overspent on groceries again!” And you’re trying to make adjustments to fix it after the fact.

With Qube, because you’re opening that Qube in the moment, you know that that money is there. And if there’s not money available, you either need to change your priorities and shift money from one Qube to another or just realize you can’t make that expense.

It stops it before the transaction happens!

This is the reason that cash envelopes have worked for so many people, except for the fact that they’re incredibly difficult to manage. Nobody wants to carry cash around. And of course that’s a major security risk.

I love that Qube gives you the ability to be proactive and intentional with your spending, while also avoiding the time commitment and headache of cash envelopes.

2 - Qube Money Makes Your Money Secure

When you think about spending with cash envelopes or a debit card generally, your money is at risk. If you lose your cash or your card, someone can easily spend your money and you have limited protections. (Especially as more debit cards have Visa and Mastercard logos and don’t always require your pin to make a transaction.)

While your Qube Money card is a debit card, it’s default balance is $0. There is nothing to spend on the card until you open a Qube.

So, even if you lost your card or someone got your account number, no one would be able to make a transaction without a Qube being open.

There are also no overdrafts meaning no overdraft fees!

The way the Qube card works, if you haven’t opened a Qube or there’s not enough money in the Qube, it will deny the transaction and you can try again. When a transaction fails, a notification pops up on your phone and gives you an alert that says, “A transaction has been tried at Barnes & Noble but a Qube has not been opened. Would you like to open a Qube?”

And it really makes this whole thing secure and easy.

3 - Your Budget Is Always Accurate

With Qube, my budget’s accuracy isn’t dependent on whether or not I’ve remembered to go in and update transactions.

It doesn’t matter if I’ve been on vacation and have forgotten for a week or two to go in.

It is just up to date because it is immediately reconciling that expense as you spend. The app takes the money out of the Qube you opened, making the transaction, and putting what’s left back in that same Qube reflecting how much you have left.

There is no tracking or categorizing expenses, it happens automatically as part of the process. This saves us so much time and let’s us make decisions with consistently accurate information.

4 - Qube Keeps You On The Same Page With Your Partner

In most households, one person is the primary manager of the budget. The other person’s knowledge day-to-day is based on conversations that are had with the main manager. (Or, when they aren’t had, issues are caused.)

It will surprise no one that in our house, the manager is me. Which means that in the past my husband would text me questions like, “How much is left in the grocery budget?” or “Do we have money for this tool I need at the hardware store?”

Could he have looked in YNAB? Sure. But it found it very overwhelming and wasn’t sure when I had last reconciled the numbers in there. Meaning he didn’t know if he could trust those numbers.

Now, because Qube is always accurate, he feels much more confident with and in control of our spending.

Qube saves us time – both from tracking and conversations that are now unneeded – and money because we both know exactly where the budget stands at all times.

It’s a beautiful thing!

How Qube Money Works

To see a complete walkthrough of how Qube Money works, from opening the app and funding your account to making a purchase, check out this clip of our review video.

Step 1: Deposit Money Into Your Qube Account

When you first set up your Qube account (issued by Choice Financial and FDIC insured), you’ll have a one-time opportunity to do a free “Instant Deposit” of $25 to $100. This uses a debit or credit card to instantly add money to your Qube account and help you get started using the app.

After this Instant Deposit, you can use an ACH transfer, direct deposit, or cash app to fund your account.

This deposit will go into your “Qube Cloud” and will need to be moved into spending Qubes to be spent with your card. So the next step is setting up your Qubes!

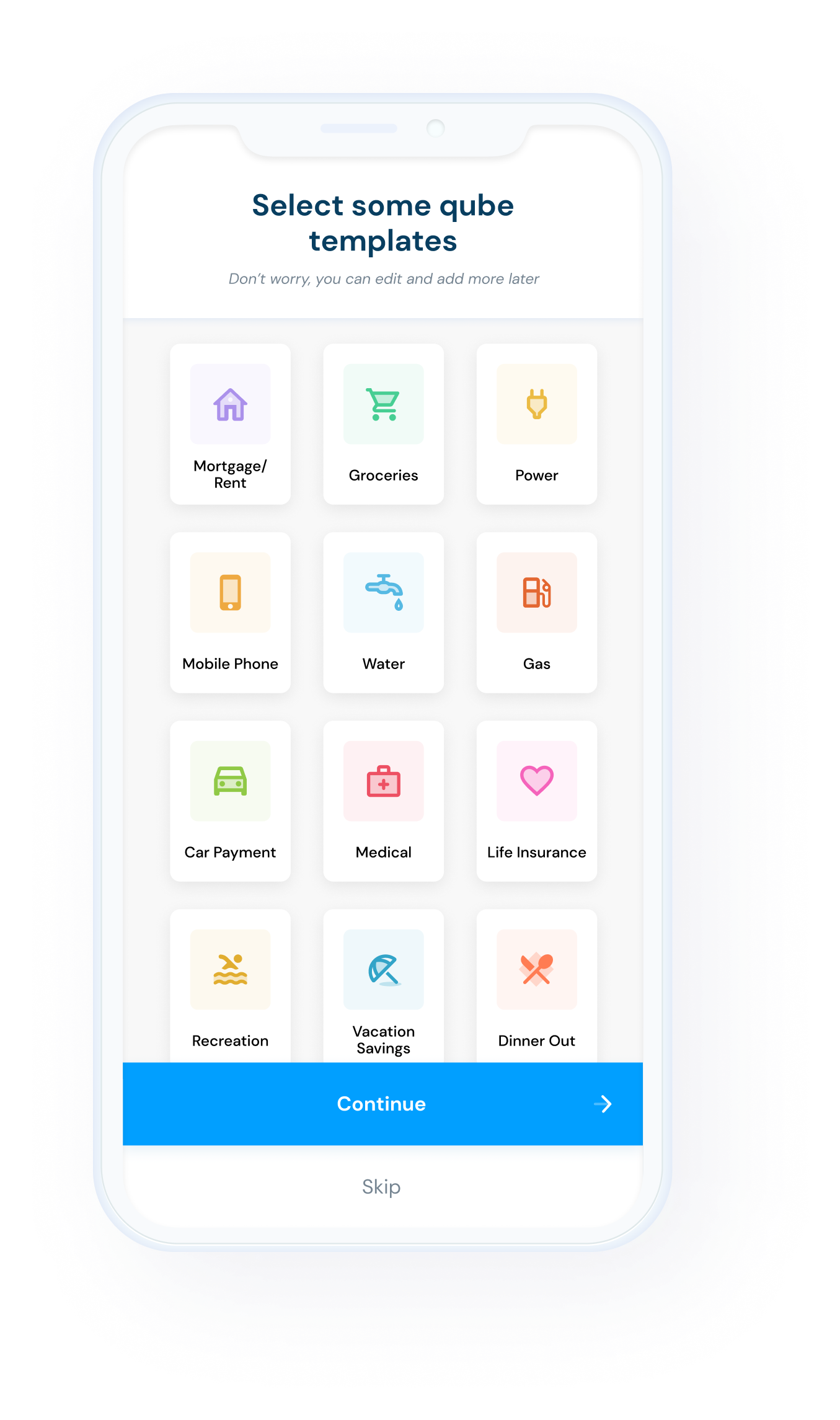

Step 2: Set Up Your Spending Qubes

Now it is time to determine which Qubes you want in your account. With the free plan, you get up to 10 Qubes but with the Premium account you have unlimited Qubes.

Great starting options are Groceries, Dining Out, Clothing, or Fun Money, as these tend to be many people’s problem accounts. But you choose what works for you!

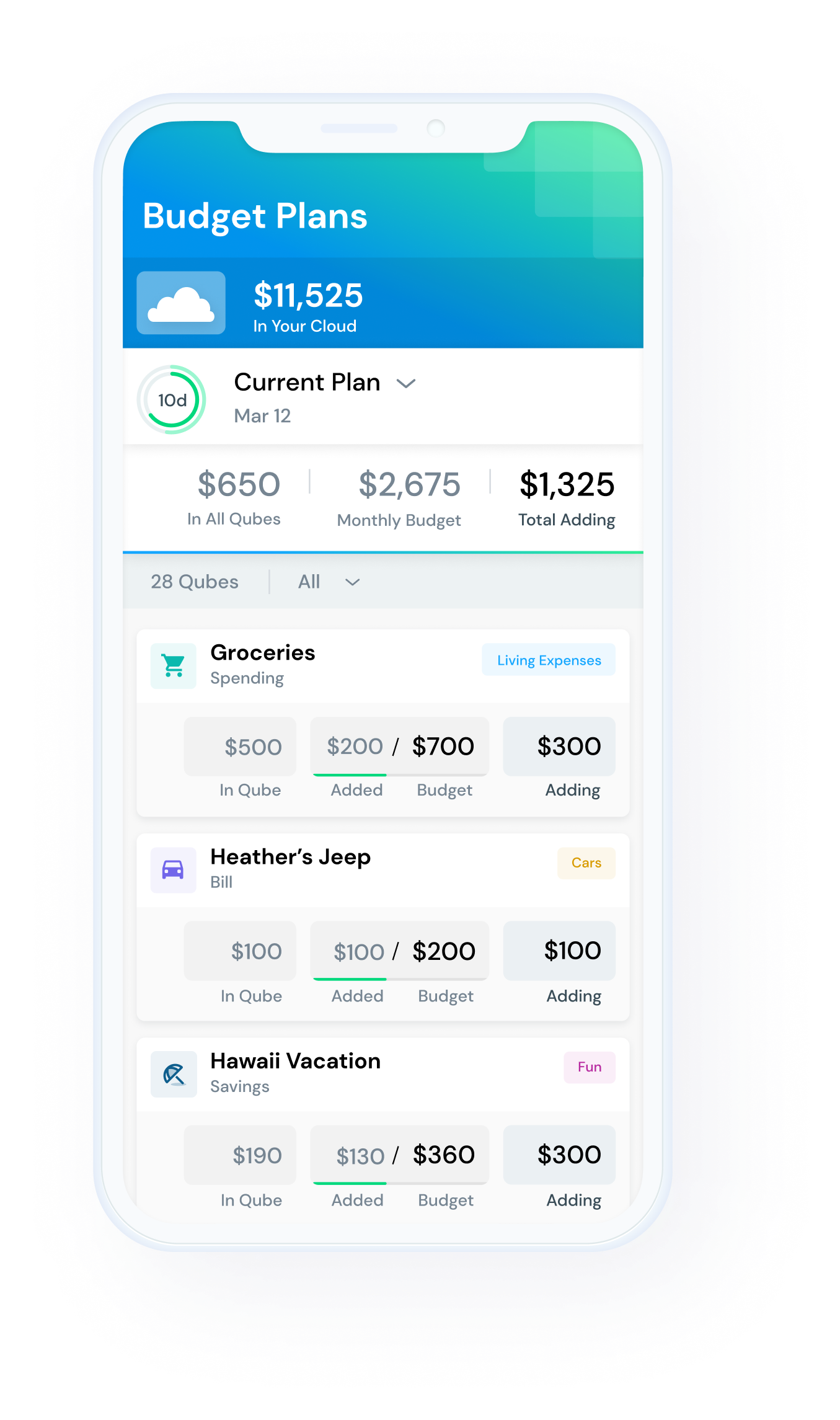

Step 3: Allocate Your Funds

Step 4: Spend With Purpose!

Now that the money is in your Qubes, you can spend it as you like with your debit card, Apple Pay, Google Pay, or other digital wallets like Walmart Pay.

Simply tap the Qube you want to spend from to open the Qube (hitting the amount in the Qube opens it automatically). The money from that Qube is added to your Qube card in seconds. Then, simply tap your phone or card to purchase!

The amount remaining in your Qube after the transaction is moved back into that Qube so your card once again has a zero dollar balance until you open another Qube.

Your spending plan will always be up to date and you’ll be spending intentionally!

You Don't Need to Wait for Your Qube Card to Spend!

As soon as your Qube account is created, you’re issued a card number which you can find by clicking the three lines in the lower right then clicking “Card Information”.

By adding your card number, expiration date, and security code to Apple Pay, Google Pay, or whichever digital wallet you use, you can start spending the same day you join Qube!

How Much Does Qube Money Cost?

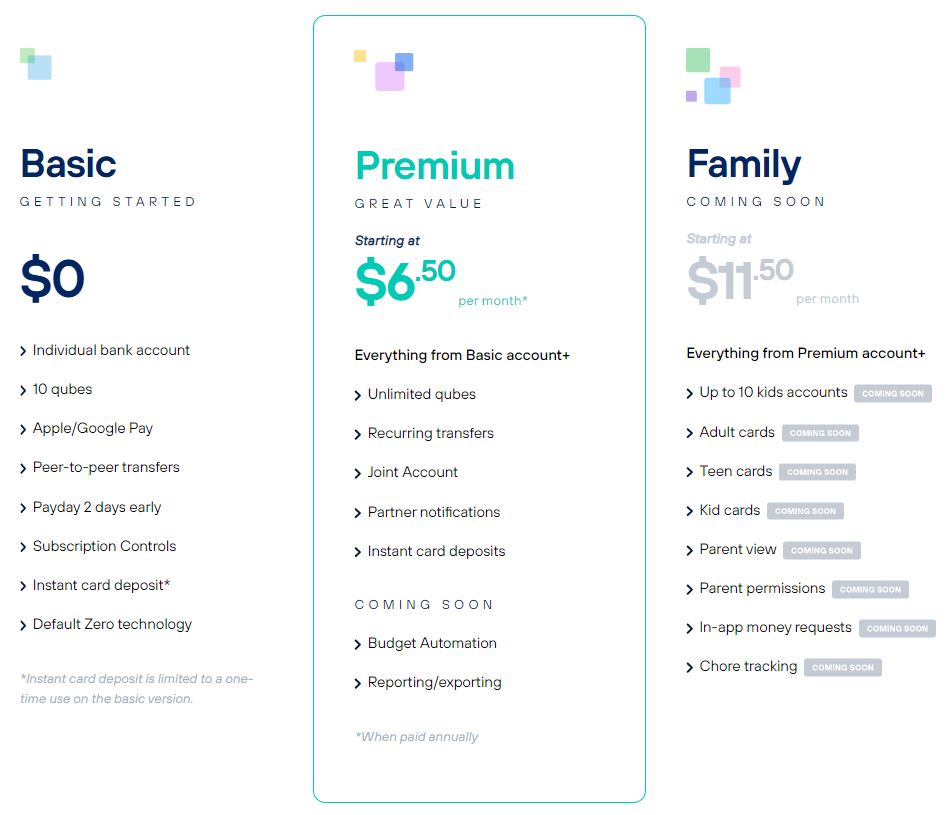

Qube Money currently offers two levels of service with a third on the way.

Qube Money starts with a free plan that offers an individual bank account, 10 spending Qubes, subscription controls, and more.

Their Premium plan adds joint accounts, unlimited Qubes, bill pay Qubes, and recurring transfers. It costs $8/mo or $78/year if paid annually. This is the plan I am on, as my husband and I wanted a joint account and more Qube options.

The Family Plan is still in the works, but will add up to 10 kid accounts, kid and teen cards for managing allowance and kids’ spending money, and parent permissions. We are looking forward to this, as digital allowance is a fantastic lesson for kids who will have to manage money in a digital age. And I love being able to keep us all working on the same platform.

Qube Money Features You Can't Miss

Just the ability to track our Qubes and have this digital cash envelope system that connects with our debit card and stops us before we make an expense is enough reason to fall in love with Qube. But there were a few specific features that we think will have you rushing to download the Qube Money app too!

Amazon Transaction Qube

Anyone who has ever budgeted before knows the pain of categorizing Amazon transactions.

One purchase can actually be processed at multiple times and in different amounts, based on when items are shipped. So, when you see an Amazon transaction in your account after the fact, it’s hard to know what item it is without downloading all of your invoices. (Because the transaction amount isn’t the same amount as your order value.)

Not with Qube!

Qube has an automatic Amazon Orders Qube. When you’re about to place an Amazon order, you open a Qube and hit “Spend” (little green box with an arrow to the right). Hit “Amazon Order” and enter the total amount including tax.

This with authorize that total purchase amount to Amazon, from the category you’re spending from, and the Amazon Orders Qube will manage approving those transactions automatically as they come through.

You can even fund your Amazon Orders Qube from multiple spending Qubes, if you’re purchasing items that should be covered from multiple categories.

No handling it after the fact or clicking through invoices!

Pre-Authorization Feature

If Qubes have to be open for a transaction to go through, how do you handle transactions where you don’t know exactly when they will process? The pre-authorization feature!

We have a Grove Collaborative subscription for our cleaning and household supplies. But the value of that order changes each month based on what we need. So, when I confirm my order with Grove for the month, I simply pre-authorize a transaction of that amount from our Household Goods Qube. Then, when Qube sees a transaction of that amount come through, it automatically opens the Qube and processes the order, matching it with the pre-authorization.

But you can use this feature for planning as well!

When you create a pre-authorization, it reduces the money available in the related Qube by that amount. That way, you don’t overspend and end up not able to cover the pre-authorized expense in the future.

So, when friends call to invite us out to dinner in two weeks, I simply create a pre-authorization for how much I expect to spend at dinner, name it for our friends, and effectively set aside that money.

It keeps us from ordering takeout 4 nights before our dinner date (because we’ve forgotten, obviously) and ending up over budget.

Subscription Management

Qube has Bill Qubes to let you manage recurring transactions. You can fund your bill Qubes with the amount of the bill, set the amount and due date, and Qube will be sure to process the transaction on that date.

This makes sure that bills are paid on time and that you aren’t overcharged!

Yet, it has a special skill when it comes to subscriptions like Netflix, Hulu, or any other membership.

Recently, I had a sticker membership I wanted to test. (Market research for my side hustle, Wildly Enough.) Well, after a month I asked for it to be cancelled. They said it was, but I was charged again the next month. And again the next month. So, after arguing with them for a refund twice I simply turned off the Bill Qube for that subscription.

Qube won’t process anymore payments, which will shut down my membership. Easy peasy. You have total control of who gets paid and when.

Instant Internal Transfers

We set our budgets with the best intentions. But, life happens. What can I say, we aren’t fortune tellers.

So, when it turns out you need more money for Fuel or Groceries, simply review in which cash you might have a little extra cash. Then, make an internal transfer between Qubes to put your money where you need it.

Internal transfers are instant, so you can make the purchase you need to right away and carry on with your day.

Your budget needs to be flexible because life is unpredictable. Instant internal transfers makes that possible.

Drawbacks of Qube Money

No money management is perfect and constantly looking for one that is will keep you switching around until the end of time. (And not actually building a consistent intentional spending habit.)

Instead, you need to find a system that’s drawbacks are more than offset by it’s benefits. And that you can work with in your life. So, let’s address some of the drawbacks of Qube.

1 - Can't Spend With Credit Cards

When you’re spending with your Qube account, you are using a debit card and not gaining credit card points. This is the first concern we hear from people new to Qube and if you’re not willing to reduce your use of credit cards, Qube may not be for you.

But while credit card points can help you travel or gain other rewards, research shows that people who use credit cards spend significantly more than people who don’t. Even if you pay your card off in full every month, you’re likely not aligning your spending with your goals and values as much as you could.

(Everyone things this isn’t them, but try using Qube for 30 days and see the difference. There are some interesting mental things at play here. I would have sworn we were very intentional with our money but have been saving hundreds of dollars a month more since switching to Qube.)

The most you earn back from credit card rewards is usually 1% to 5%. I’d expect you’d save a lot more than that using Qube, and can you can put that savings towards what matters most to you.

2 - Qube Doesn't Provide Holistic Picture of All Your Money

Qube only accounts for money in your Qube account and budget categories related to your specific Qubes. It doesn’t show your savings accounts, other checking accounts, credit card expenses, or investment accounts.

This can make it difficult for people to see the whole picture of their financial standing if they use accounts other than Qube.

We’ve found that Qube is the absolute best option to manage our day-to-day spending. All of our regular spending categories (groceries, dining out, fuel, medical, kids’ expenses, family fun, etc.) are managed in Qube.

But, for a longer-term and broader view of our money, we still use YNAB. We simply have a line item in YNAB for funding our Qube account. Qube saves us from having to update all those little regular expenses in YNAB and YNAB lets us set up long-term sinking funds and see our money across all accounts.

If your saving and spending outside of Qube is largely on auto-pilot, you may not need a second tool. But you want to make sure you have a plan to get a full view of your money.

Upcoming Features: Tracking Qubes

Qube is working on releasing “Tracking Qubes” that would allow you to track and categorize expenses not made with your Qube account. Other bank accounts, credit cards, etc.

The release date is not yet set, but there is a solution to this limitation in the works.

3 - Qube Money is a Relatively New Company

Qube Money being a startup has many benefits. It means a tool that is innovative and changing the way we budget and bank. And it doesn’t make your money any less secure. Your Qube account is issued by Choice Financial Group and is fully FDIC insured up to $250,000.

However, Qube is still constantly releasing new features, responding to customer requests for new tools and improved interfaces, and growing. This can mean having to deal with slight changes to how things are done within the app.

I’ve found Qube easy to use with limited bugs – and I’m excited to see many of the new features Qube is rolling out (like their Family Plan and kid accounts) but a rapidly growing platform isn’t a comfortable choice for everyone.

Is Qube Money Right For You?

No one budgeting system is perfect for everyone. But I can say without a doubt that Qube is saving my family time, money, and sanity as we manage our most active spending categories.

I highly recommend downloading the Qube Money app and trying it for 30 days (you even get two months of Premium for free with the code MONEYMAMA.) You can choose just two to three of your most troublesome spending categories to move to Qube. Then, after 30 days, consider how much you’ve saved and how you feel managing those categories with Qube.

I’m confident you’ll be feeling more in control of your spending!

The post Qube Money Review: Best Digital Cash Envelope App appeared first on Smart Money Mamas.